Citi analysts have recently updated their precious metals price forecasts, reflecting a bullish outlook. They have raised their gold price forecast for the next three months to $2,800 per ounce from the previous $2,700, citing factors such as a worsening U.S. labor market, increased physical and ETF gold buying, and anticipated interest rate cuts by the Federal Reserve. This new target surpasses the recent peak of $2,772 for December gold futures (GCZ24).

Similarly, Citi has revised their 6-12 month silver price target upward from $38 to $40 per ounce, contrasting with December silver’s (SIZ24) recent high around $35.

For investors seeking to capitalize on potential further increases in silver prices, mining stocks are often a correlated asset. Below are two penny stocks that could benefit from continued silver price appreciation.

#1. Avino Silver and Gold Mines Ltd. Avino Silver and Gold Mines Ltd. (ASM) is a mineral resource company. It is involved in the exploration, extraction, and refining of gold, silver, and copper (HGZ24). The company also advances mineral properties. ASM owns interests in 42 mineral properties and has 4 more leased claims. Incorporated in 1968, it operates in Canada and Mexico. Its headquarters is in Vancouver, Canada. With a market cap of $194.05 million, ASM stock is up nearly 172% YTD. Avino Beats Estimates. Avino Silver reported its Q2 results on Aug. 13. It posted record revenue of $14.8 billion, a 60% surge from the same quarter last year. It comfortably beat analysts’ $14.0 million estimate. Adjusted earnings per share (EPS) for the quarter was $0.03, edging out the market’s $0.

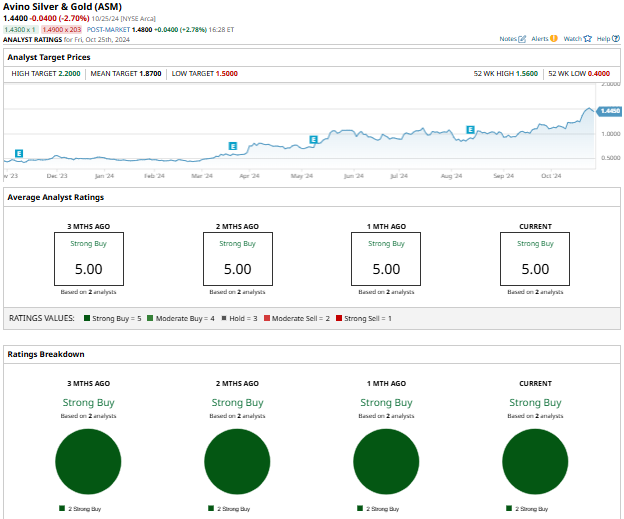

ASM posted a mine operating profit of $4.7 million, up from last year’s $1 million profit. EBITDA was $3.4 million, compared to $0.4 million in the previous year. Avino ended the quarter with a cash reserve of $5.3 million. The beat was driven by the increase in payable silver per ounce sold, a decrease in mining costs, and rising metal prices. Year-to-date capex totaled $3.3 million at the end of the quarter, down from $5.6 million in the same period of 2023. For the year, management expects 7-7.5 million tons of mill processing sourced from Avino Mines and stockpiles from La Preciosa. Production is anticipated at 2.5-2.8 million silver equivalent ounces. Although coverage is light, the two analysts tracking ASM are optimistic about the mining stock, with a unanimous “Strong Buy” rating and a mean price target of $1.

Investors seeking high potential returns in the penny stock market should consider these two ‘Strong Buy’ silver miners.

#1. Vizsla Silver Corp.

Vizsla Silver Corp. (VZLA), a Canadian company, is an advanced-stage exploration, acquisition, and development mineral mine property company. They specialize in exploring for gold, silver, and copper deposits. Originally known as Vizsla Resources Corp, the company rebranded in 2021 and is headquartered in Vancouver, Canada. VZLA’s stock has seen a significant increase of 71.6% year-to-date (YTD) and has a market capitalization of $527.3 million.

As a pre-revenue company, Vizsla Silver Corp. is considered a higher-risk investment. The company’s primary focus is its flagship Panuco silver-gold project in Sinaloa, Mexico, which it fully owns. Recently, Vizsla completed the acquisition of the La Garra-Metates district in the Panuco-San Dimas corridor. The company aims to start silver production in the second half of 2027 and currently has approximately $107 million in cash to fund operations. This cash is expected to last until the delivery of a feasibility study in the second half of 2025.

#2. Upside Potential

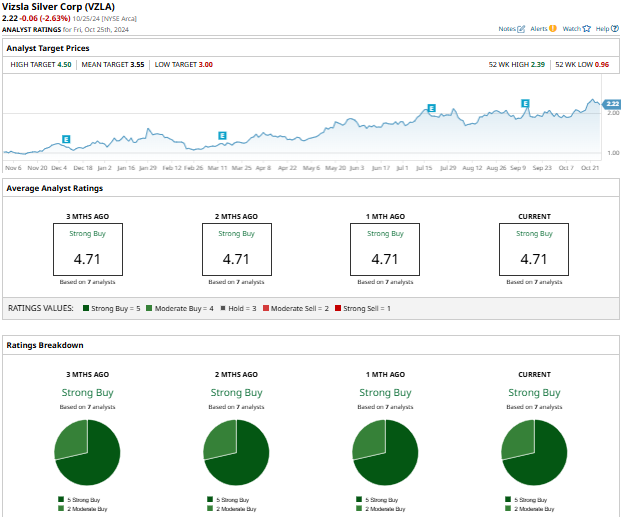

Analysts have given Vizsla Silver Corp. a target price of $87, indicating an upside potential of more than 32% from the current price.

Analysts have a favorable outlook on penny stocks, particularly VZLA. With seven analysts covering the stock, it has received a consensus ‘Strong Buy’ rating.

The average price target for VZLA is $3.55, which indicates a potential increase of 66% from the current price.